Is the current investment property mortgage rate environment crushing your hotel deal flow? For many investors, the sharp rise in commercial interest rates feels like an insurmountable wall, slowing the acquisition of hotels, motels, and recreational assets.

However, the noise of high rates distracts from a powerful truth: the hospitality sector remains robust. According to the American Hotel & Lodging Association (AHLA), U.S. hotel guest spending is projected to reach a record $777.25 billion in 2025, surpassing the previous record. This is a clear indicator that strong market fundamentals still exist—if you can secure the right financing.

This guide will demystify the complex world of hospitality investment property lending. We will navigate the challenges of high rates and show you how to find opportunities. The solution lies with an expert financial partner: HotelLoans.Net. As an industry-leading correspondent and table lender, we can underwrite your deal with advantageous terms, including up to 30-year amortization, and leverage a network of over 1,000 private lenders, investors, brokers, and realtors to connect you with the right capital. Let us empower your subsequent hotel investment property acquisition.

Table of Contents

ToggleThe Truth About Current Investment Property Mortgage Rates vs. Primary Residence Loans

The current investment property mortgage rates for commercial assets like hotels are consistently higher than those for a family home. This premium—often ranging from 0.5% to 1.5% or more—isn’t arbitrary; it’s a direct reflection of the heightened risk lenders assume when financing a business rather than a personal residence.

The Rate Hike: Why Hospitality Loans Cost More

The fundamental difference lies in the risk profile between commercial and residential lending.

| Risk Factor | Primary Residence | Commercial Hotel Investment |

| Lender Recourse | High (Borrower’s income/assets) | Limited/Non-Recourse common |

| Occupancy Stability | Highly stable (Owner-occupied) | Highly volatile (Daily/seasonal fluctuations) |

| Income Source | Borrower’s personal W-2/Salary | Business performance (Cyclical, operational) |

| Foreclosure Risk | Lower (Borrower prioritizes housing) | Higher (Business failure risk) |

A hotel loan is essentially a loan on an operating business that is housed in real estate. The income stream that services the debt is vulnerable to economic cycles, tourism trends, and local competition. Unlike a residential borrower who is highly motivated to protect their home, a hotel’s performance relies on operational metrics:

- Average Daily Rate (ADR): The average rental income per occupied room.

- Revenue Per Available Room (RevPAR): The gold standard metric, calculated as Occupancy Rate * ADR.

Lenders track these metrics closely. A significant dip in occupancy or ADR due to a recession or a new competitor can immediately compromise the Debt Service Coverage Ratio (DSCR) and push the property toward default. This high volatility—the cyclical demand and business risk—is precisely what mandates the premium on current interest rate mortgages for investment property in the hospitality sector.

According to the Federal Reserve and industry data, commercial lending overall shows higher default volatility than residential mortgages, particularly in highly cyclical sectors such as hotels. That minor rate difference—the premium—is the lender’s hedge against that risk.

The Agitation: The Cost of a Premium

On a $10 million loan amortized over 30 years, an extra 1% in interest rate isn’t just a rounding error; it can easily translate into hundreds of thousands of dollars in additional interest paid over the life of the loan.

| Hypothetical Current 30-Year Fixed Rates (Approx.) | ||

| Primary Residence Rate | Residential Investment Rate | Commercial Hotel Investment Rate |

| 6.75% | 7.25% | 8.00%−9.00% |

This underscores the need to work with an expert correspondent like HotelLoans.Net. The difference between a retail bank’s high rate and a competitively brokered or table-funded rate can directly impact your deal’s profitability and long-term equity return.

Factors That Lock In Your Best Current Investment Property Mortgage Rate

While the underlying risk dictates the premium, your specific financial profile and property characteristics determine your final pre-approval mortgage rates for a current investment property. Lenders primarily focus on these key risk mitigants:

- LTV (Loan-to-Value) / Down Payment: For hospitality deals, lenders require significant borrower equity. A down payment of 30% to 40% is typical, resulting in a lower LTV, which directly reduces lender risk and secures a better rate.

- DSCR (Debt Service Coverage Ratio): This is the lender’s primary measure of a property’s income-generating stability, calculated by dividing the property’s Net Operating Income (NOI) by its annual debt service. Lenders typically require a DSCR of 1.25x to 1.40x or higher for hotels. A higher ratio demonstrates a healthier cash flow cushion, leading to a more favorable average current mortgage rate for investment property.

- Sponsor/Borrower Experience: In hotel deals, lenders place immense trust in the operator. A proven track record in hotel management and ownership is critical. First-time operators will face steeper rates or require a strong third-party management agreement.

- Property Type and Brand: Branded properties (e.g., Marriott, Hilton) are generally viewed as lower risk than independent/boutique hotels due to established booking systems and quality standards. A fix-and-flip/hold strategy will also carry higher initial rates until the property is stabilized.

Image: How to secure the best mortgage rate for an investment property?

Finding the Right Rate: Specialized Loans for Hospitality Investment Property

Securing the optimal current loan mortgage rates for investment property isn’t about finding the lowest number; it’s about matching the loan type to your investment strategy. A hospitality investment property deal requires specialized financing—a bridge loan for a quick renovation won’t work for a long-term, cash-flow-focused acquisition. The solution is knowing the products and having a partner like HotelLoans.Net to unlock them.

Agile Financing: Bridge Loans and Hard Money for Fast Hotel Deals

When time is critical—for a fix-and-flip or a hospitality construction project where quick closing is key—you need speed over long-term, low rates. This is the domain of Bridge Loans and Hard Money.

Bridge Loans: These are short-term, interest-only loans (typically 6 months to 2 years) designed to “bridge the gap” between an immediate need and securing permanent, long-term financing (the “take-out” loan). They are ideal for:

- Acquisition with Repositioning: Buying an underperforming hotel, funding necessary renovations, stabilizing operations (improving RevPAR/ADR), and then refinancing into a permanent loan.

- Quick Closings: Executing a purchase faster than a traditional bank or government loan allows, often closing in as little as 30-45 days.

Hard Money Loans: A subset of bridge lending, these are primarily asset-based. The decision is heavily weighted on the property’s value and potential rather than the borrower’s financials or the property’s current cash flow. They carry the highest current mortgage rate investment property can have (often in the high single digits or low teens, plus points) but offer the maximum speed and flexibility, making them essential for distressed asset purchases or time-sensitive fixes.

The trade-off for speed and flexibility is the higher rate. However, this high rate is only temporary. Your success relies on having an exit strategy—refinancing into a low-rate, long-term loan before the bridge loan matures.

Solution: HotelLoans.Net is uniquely positioned to handle this niche. We connect you directly to our proprietary network of over 1,000 private lenders, investors, brokers, and realtors who specialize in these short-term, higher-risk commercial notes. This capability is vital for investors looking to execute aggressive, value-add hotel strategies.

Long-Term Stability: CMBS, SBA, and Conventional Term Loans

For investors with a “fix and hold” strategy or those planning new construction, a long-term, low-rate solution is essential for maximizing cash flow and equity returns.

DSCR Loans: Income-Based Financing

DSCR (Debt Service Coverage Ratio) loans are becoming popular for smaller, stabilized assets, such as motel and restaurant investments.

- The Assessment: These loans qualify based on the property’s cash flow potential, not the borrower’s personal income (no tax returns or W-2s required). Lenders verify that the property’s Net Operating Income (NOI) is comfortably greater than its debt service, typically seeking a DSCR of 1.25x to 1.40x or higher for hospitality.

- The Popularity: They are a powerful solution for experienced investors with complex personal financials, multiple business ventures, or those seeking a streamlined, documentation-light process. They offer attractive investment property mortgage rates, current for low-leverage, high-cash-flow assets.

SBA 504 and 7(a) Loans: Government-Backed Advantage

The U.S. Small Business Administration (SBA) loan programs are a game-changer for owner-occupied hospitality investments, providing the longest terms and lowest current 30-year mortgage rates available.

- SBA 7(a) Loans: The most flexible option, covering acquisition, construction, equipment, and working capital up to $5 million. They offer terms up to 25 years with competitive rates, often reducing the equity injection required.

- SBA 504 Loans: Ideal for large fixed-asset projects (real estate and heavy equipment). They are structured into three parts: a private bank loan (typically 50%), the SBA-backed loan (usually 40%), and the borrower’s down payment (as low as 10-15%). This structure locks in a long-term, fixed rate on the SBA portion for 20 or 25 years, offering stability and low monthly payments. According to the SBA, the 504 program supports billions in small business lending annually, providing a reliable source of capital for development and acquisition.

Conventional and CMBS Term Loans

- Conventional Term Loans: Provided by banks, credit unions, and life insurance companies, these offer competitive current mortgage rates for refinancing investment property or stabilized purchases. They are best for well-managed, branded hotels with a strong operational history.

- Construction-to-Permanent Loans: A critical solution for new developers. This is a two-phase loan: a higher-rate construction loan that funds the build, which then seamlessly converts into a lower-rate permanent financing (term loan) upon stabilization and completion.

- Lite-Doc & No-Doc Loans: For the most experienced investors with immense personal wealth or complex international financials, these term loans offer the ultimate convenience, requiring minimal documentation (such as tax returns) in exchange for a slightly higher rate and a fast, simple closing process.

HotelLoans.Net ensures you don’t default to a high-rate bank loan. We underwrite your deal for its maximum potential—including up to 30-year amortization—and efficiently match your strategy to the perfect long-term capital solution.

15-Year vs. 30-Year: Your Current Mortgage Rates Investment Property Dilemma

The choice between a 15-year and 30-year amortization schedule for your hotel deal is the ultimate trade-off between long-term savings and short-term operational freedom. While the current 15-year mortgage rates for investment property offer a clear advantage in interest costs, the current 30-year mortgage rates for investment property often hold the key to maximizing cash flow and lender confidence in the volatile hospitality sector.

The 15-Year Advantage: Lower Interest, Higher Payment

Shorter loan terms present lower risk to the lender; therefore, they consistently offer lower average investment property mortgage rates—often 0.5% to 0.75% lower than for a 30-year term.

- The Benefit: Significant reduction in total interest paid over the life of the loan. On a $5 million hotel loan, these interest savings could amount to hundreds of thousands of dollars.

- The Drawback (Agitation): The significantly higher monthly principal and interest (P&I) payment. This places immense pressure on a property’s monthly cash flow.

For a hotel, where income is often cyclical, seasonal, and subject to economic dips, that large, inflexible payment can be dangerous. A 15-year term is typically best suited for low-leverage vacation investment property with strong, predictable seasonality and an experienced owner who can easily absorb high monthly carrying costs.

The 30-Year Stability: Higher Interest, Better Cash Flow

While current mortgage interest rates for a 30-year term are higher, the commercial hotel investment property segment overwhelmingly prefers this structure, even at current mortgage rates.

- The Stability: Spreading the debt service over 360 months drastically reduces the monthly P&I payment. This is crucial for maximizing the DSCR (Debt Service Coverage Ratio), the lender’s most crucial risk metric. A low monthly fee provides a wider cushion against revenue dips, making the loan more attractive to the lender.

- Operational Liquidity (The Solution): Lower payments mean more operational liquidity for the hotel. Hospitality assets require constant reinvestment (CapEx, PIPs), marketing, and staffing. Sacrificing a slightly lower rate for superior cash flow allows the investor to maintain quality, improve the property, and survive unexpected economic downturns. This is why, for large-scale hotel investment properties, a 30-year term is a necessary tool for responsible financial management.

The Agitation: The higher current mortgage interest rate for investment property is worth it if it saves your operating budget. The risk of default from a negative cash flow cycle far outweighs the long-term interest savings of a 15-year loan.

Fixed vs. Floating Rates: Market Sentiment (2025/2026 Outlook)

The decision between a fixed (rate locked for 5, 7, or 10 years) and a floating (variable) rate is driven entirely by the Federal Reserve’s projected direction.

- Fixed Rate (The Safe Harbor): Provides certainty of monthly payments, insulating the investor from sudden rate hikes. This is the preferred choice for long-term holders seeking stable cash flow.

- Floating Rate (The Calculated Risk): The rate is tied to an index (such as SOFR) plus a margin, which makes it fluctuate. It is initially lower than a fixed rate but carries the risk of sharp increases.

Current Market Outlook (2025/2026):

The current sentiment in late 2025 suggests that the period of aggressive rate hikes is likely over. Financial analysts are now discussing the potential for gradual, selective rate cuts through late 2025 and into 2026, aiming for inflation targets.

- Recommendation: Investors with a short-term, value-add strategy (1–3 years) may opt for a floating or short-term fixed rate (e.g., 2-year) to take advantage of expected rate reductions and secure a lower interest cost before the permanent refinance.

- Long-Term Holders: Despite potential future cuts, most long-term hotel investors continue to favor longer fixed terms (5, 7, or 10 years) for stability. The predictability of debt service in a high-CapEx business outweighs the speculative savings from a variable rate.

HotelLoans.Net specializes in structuring the optimal term—often underwriting for a 30-year amortization regardless of the chosen term/rate—to ensure maximum DSCR and cash flow.

Maximizing Your Clients’ Current Investment Property Mortgage Rates: The Power of a Correspondent Lender

In today’s tight credit market, the difference between a deal that closes and one that stalls often comes down to the quality of the financing source. When seeking the best current mortgage rates single unit investment property or large hotel portfolios, relying solely on local banks is a significant disservice to your client. You need an intermediary—the lender—who has the reach of a national broker.

Beyond Banks: Accessing Private Capital for Better Terms

Traditional commercial banks offer limited product suites and have increasingly conservative lending appetites for hospitality assets, particularly in a high-rate environment. They may shy away from the volatility of a hotel’s income stream. This is where the power of a correspondent and table lender becomes essential.

The HotelLoans.Net Advantage (The Solution): We don’t just broker your loan; we are both a correspondent lender and a table lender. This means we can underwrite the loan ourselves, cutting out layers of red tape and providing speed and certainty of closing that banks cannot match. Simultaneously, we leverage our proprietary network of over 1,000 private lenders and institutional investors—including CMBS desks, insurance companies, and private debt funds—to competitively bid on your client’s deal.

- The Result: Your client bypasses the lengthy bank process and accesses a broader range of capital sources, including those that offer better terms and lower current mortgage interest rates for investment properties such as hotels, motels, and recreational assets. This dual capability ensures the client receives the lowest risk-adjusted rate available in the entire market, not just from the bank down the street.

The Value of 30-Year Underwriting Expertise

One of the most significant benefits HotelLoans.Net offers is the ability to underwrite and arrange loans with a 30-year amortization schedule.

- The Benefit for Investors: As established earlier, a 30-year amortization schedule significantly reduces monthly debt service payments. For example, a $7 million loan at 8% interest, amortized over 30 years, has a monthly payment about 18% lower than the same loan amortized over 20 years. This lower payment significantly improves the property’s DSCR, enhancing underwriting metrics and maximizing cash flow, thereby protecting the long-term investment.

- The Expertise: Many conventional lenders cap commercial hotel amortization at 20 or 25 years. Our expertise in placing these deals with long-term capital sources (such as CMBS and specific institutional lenders) enables us to structure maximum amortization, giving your client the strongest possible financial footing.

By providing this specialized expertise, we turn otherwise challenging high-rate deals into viable, cash-flow-positive acquisitions for your clients, whether they are purchasing a multifamily investment property converted to short-term rentals or a large, flagged hotel.

Exclusive Broker Referral Programs

Are you a hospitality real estate broker, realtor, or intermediary who needs reliable financing for your client listings? Your deal flow is too valuable to be left to the uncertainty of traditional banks.

Partner with HotelLoans.Net to provide your clients with unmatched financing solutions. We offer flexible, exclusive, and non-exclusive referral programs that provide you with a commission for every closed deal you refer. By coupling your market expertise with our capital solutions and 30-year underwriting advantage, you can increase your closing ratio and ensure a smoother transaction process for your clients.

Ready to elevate your closing power in the hospitality sector? Let’s discuss a partnership that maximizes your clients’ financial leverage.

Strategic Refinancing and Market Outlook for Current Investment Property Mortgage Rates

Future-proofing a hotel acquisition requires more than just securing the best initial current mortgage rates for investment properties; it demands a clear, executable exit strategy. In the high-rate, volatile environment of late 2025, the strategic use of short-term debt with a clear refinancing plan is the most powerful tool for maximizing long-term returns.

Timing Your Exit Strategy in a Volatile Market

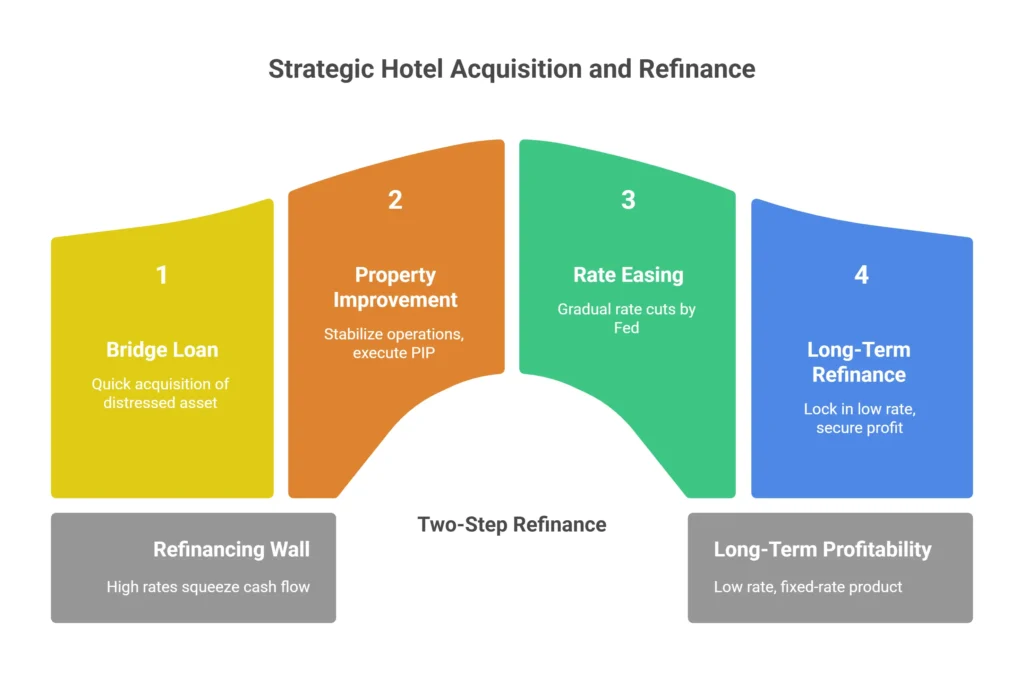

The current market is defined by a Refinancing Wall, where many hotel owners face balloon payments on loans originated during the lower-rate period of 2020-2022. These loans are now due for renewal at significantly higher rates, squeezing cash flow and forcing sales. This distress creates acquisition opportunities for savvy investors who finance strategically.

- The Acquisition Strategy: The smart move today is to utilize short-term, high-speed financing, such as a Bridge Loan. This allows the quick acquisition of a distressed asset and provides 1-3 years to execute a Property Improvement Plan (PIP) or stabilize operations. The goal is not to keep this high-rate loan, but to hold it just long enough until market conditions improve.

- The Refinance Trigger (Action): The consensus among economists, including those at the Federal Reserve, suggests a period of gradual rate easing (rate cuts) is likely to continue through late 2025 and into 2026. Projections show the Fed Funds Rate trending lower in 2026, which generally correlates with a reduction in current mortgage rates on refinance investment property.

- The Take-Out: Once the hotel is stabilized and rates have dropped, the investor executes a Rate-and-Term Refinance or a Cash-Out Refinance into a long-term, fixed-rate product (like a 25- or 30-year conventional loan or an SBA loan). For developers, this is the classic transition from a construction-to-permanent loan. This locks in a low rate for decades, replacing the expensive short-term bridge debt and securing long-term profitability.

This two-step process—Bridge now, Refinance later—is the optimal exit strategy in a volatile market.

Image: Strategic Hotel Acquisition and Refinance

The HotelLoans.Net Economic Consulting Service

Navigating the debt cycle and the looming Refinancing Wall demands more than a transaction partner; it requires an economic advisor.

HotelLoans.Net offers comprehensive economic consulting services that move beyond just loan placement. We provide custom advisory for:

- Land Purchasing & Development: Analyzing macro-economic trends and municipal incentive programs to determine optimal timing and location for new construction.

- Long-Term Holding Strategies: Stress-testing your debt structure against various interest rate and RevPAR forecasts to ensure your hotel maintains a healthy DSCR through future economic shifts.

- Risk Mitigation: Structuring the right blend of fixed vs. floating rates based on the most current Fed and Treasury yield projections to protect your investment from volatility.

We combine our role as a primary lender with data-driven consulting, ensuring every step—from site acquisition to a 30-year hold—is financially sound.

Conclusion: Seize Your Hotel Investment Future

The high-rate environment poses a challenge, but it does not eliminate the lucrative opportunities in the hospitality sector. Success today is defined by pairing a strong hotel investment property deal with the most strategic financing partner.

We have distilled the critical insights you need to move forward:

- Understand the Rate Premium: Hospitality loans carry a necessary premium due to operational volatility, demanding a higher DSCR and greater equity from the sponsor.

- Tailor the Loan: Match your strategy—use Bridge Loans for speed and repositioning, and leverage SBA or CMBS for long-term stability and optimal mortgage rates for your current investment property.

- Optimize the Term: Embrace the 30-year amortization schedule to maximize your DSCR and operational cash flow, prioritizing liquidity over marginal interest savings.

- Harness the Edge: Use a correspondent and table lender like HotelLoans.Net to bypass bank limitations, underwrite in-house, and access over 1,000 private and institutional capital sources.

- Future-Proof: Plan your refinance now by using short-term financing to position yourself for lower rates projected for 2026.

Don’t let the current investment property mortgage rates sideline your deal flow. Work with the only correspondent that can underwrite your hotel investment property to its complete 30-year vision.

Take control of your subsequent acquisition. Contact our team today for a personalized rate analysis and pre-approval.

FAQs

1. What are the typical origination fees and total closing costs for a commercial hotel loan?

The total closing costs for a commercial hotel investment property loan typically range from 2% to 5% of the loan amount. This is higher than residential loans due to commercial due diligence. The fees include:

- Origination Fee: This is the lender’s fee for processing and underwriting the loan, usually ranging from 0.5% to 1.5% of the loan amount, and is sometimes negotiable.

- Third-Party Costs: These cover required services like appraisal, environmental report (Phase I), property condition assessment (PCA), legal fees for both lender and borrower, and title insurance.

2. Is a hotel loan typically a “recourse” or “non-recourse” debt, and what’s the difference?

Hotel loans can be either, but non-recourse loans are generally preferred for large commercial properties like hotels, especially with CMBS financing.

- Non-Recourse: The lender’s recovery in the event of default is limited to the collateral (the property itself). The borrower’s personal assets are protected. However, nearly all non-recourse loans include “bad boy” carve-outs that trigger personal liability for actions such as fraud or intentional misrepresentation.

- Recourse: The borrower (and often the principals via a personal guarantee) is personally liable for the debt. If the foreclosure sale doesn’t cover the loan balance, the lender can pursue the borrower’s personal assets. SBA and most conventional bank loans for smaller hotels are usually recourse.

3. How does the type or brand of the hotel (e.g., Branded vs. Independent) impact the commercial mortgage rate?

A hotel’s brand status significantly affects its perceived risk and, in turn, the current mortgage rate.

- Branded Hotels (e.g., Marriott, Hilton): Lenders view these as lower risk. They benefit from global reservation systems, strong loyalty programs, and consistent quality standards. This stability translates to lower interest rates and higher maximum Loan-to-Value (LTV) ratios.

- Independent Hotels: These are seen as higher risk because they lack national recognition and rely solely on local management and reputation. They typically require a higher interest rate and a more conservative loan structure (lower LTV and higher DSCR requirements).

4. What is a CMBS loan’s typical term length, and why do they often have a balloon payment?

CMBS (Commercial Mortgage-Backed Securities) hotel loans typically have terms of 5, 7, or 10 years.

- They are structured with an extended amortization period (often 25-30 years) to ensure lower monthly payments and better cash flow.

- Because the loan term is shorter than the amortization period, the entire remaining principal balance (the unpaid portion) becomes due as a balloon payment at the end of the loan term. This requires the borrower to either sell or, more commonly, refinance the debt before the term expires.

5. What is the immediate impact on the collateral if a commercial hotel loan defaults?

The immediate impact is significant because a hotel is an operating business, not just real estate.

- A hotel’s value can drop sharply if operations cease (“goes dark”), as it relies heavily on an active workforce, brand loyalty, and operating licenses.

Lenders prioritize maintaining operations. In a default scenario, the lender often appoints a professional receiver (a court-appointed manager) to continue operating the hotel, often under a new management company. The goal is to stabilize the property’s performance (RevPAR, ADR) before the eventual foreclosure or sale to prevent a catastrophic loss of asset value.